Mortgages 101

Mortgage rates are currently at the highest they have been since 2010, with more raises anticipated throughout the coming year. This has already had an effect on home sales, with a small slowdown starting to be reported as high prices, low inventory, and now rising rates are making an already competitive market seem even more difficult to maneuver.

Even if the news feels dire, this is actually a great time for real estate professionals. It’s an incredibly important opportunity for you to reach out to your sphere and show your value. You are the market expert, and in a tough market, your expertise is what will make the difference for people who need help.

When we polled our readers about how comfortable they felt with mortgages, 66.7 percent answered “poorly,” and 33 percent said they didn’t understand mortgages at all. So, consider this newsletter your mortgage bootcamp. We’re going deep, y’all.

So, What Is A Mortgage?

In its most basic sense, a mortgage is a loan secured for real estate property. With a mortgage loan, the lender will hold legal title until the loan is paid. The word “mortgage” comes from the French word for “death pledge” because the pledge “dies” when the loan is repaid or the lender forecloses for lack of payment. Mostly, people get mortgages when they are looking to purchase a home or refinance a mortgage they already have. Mortgage loans can “originate” from a mortgage banker, mortgage broker, savings and loan, credit union, or bank.

Unlike with most purchases, when someone buys a property, they’re only required to pay part of the sales price up front (with a down payment). For the remainder, the buyer takes out a loan that they agree to pay back in monthly installments over a period of years. This loan is called a mortgage loan.

A mortgage is a type of loan, but not all loans are mortgages. Why? Because mortgages are “secured loans,” which means that the buyer is pledging the property as collateral — they have, in fact, mortgaged the home until they pay back the borrowed money. If at any time before the loan is paid off the person stops making payments, the lender can re-possess the property (a process called foreclosure).

So, How Does A Mortgage Work?

When a borrower takes out a loan from a lender, they agree to monthly payments. A portion of these monthly mortgage payments applies toward the principal (the original amount you borrowed) and the other portion goes toward the interest (the cost of the loan). Over time, as you pay back the principal, you gradually start to own more and more of the home’s value. In other words, you build up equity.

Mortgages: The Basics

Mortgage loans now come in more varieties than ever. But don’t let all the different options confuse you. The differences between each type of mortgage loan boil down to four basic factors:

1. Down Payment

Generally speaking, the more a buyer puts down on a property at the beginning of a mortgage, the better interest rates they get. Plus, the overall amount of the mortgage loan will be lower. Traditionally, the goal has been to put down 20 percent (which also helps the buyer avoid Private Mortgage Insurance or PMI) but depending on the type of property and type of loan, borrowers can put down as little as 3 to 5 percent.

2. Interest Rate

An interest rate is a fee or amount charged by a lender, and it is usually a percentage of the loan amount. In general, people want the lowest interest rate possible because that means they’re paying less money in interest over the life of the loan. In addition to saving borrowers thousands in the long term, a lower rate will also reduce the amount due in each month’s payment.

Given that interest rates are rising for the first time in several years, we’ll discuss these more in-depth later in this newsletter.

3. Term

The term of a mortgage loan is simply how long the life of the loan is. Different mortgages come with different schedules around repayment. In the case of fixed-rate mortgages, loans are scheduled for repayment over larger swaths of time, like fifteen, twenty, or thirty years.

Mortgages with shorter terms have higher monthly payments and lower interest rates.

4. Fixed Vs. Adjustable Rate

When it comes to mortgages in the United States, there are a couple of different options, but they mostly fall into two categories: fixed rate and adjustable rate.

• Fixed-rate mortgages are mortgages where the interest rate is secured: the rate given at the beginning of the loan remains the same throughout the mortgage’s life. (Unless the borrower chooses to refinance).

• Adjustable-rate mortgages (often referred to as ARMs) have interest rates that fluctuate over the life of the loan. Unlike their fixed-rate counterparts, the interest rate secured at the beginning of the loan is only temporary. Usually, the starting rate for an ARM is incredibly low. Then, slowly, depending on the rate index, the interest rate may increase, if rates are on the rise.

Most of the things that affect a mortgage are under control of the consumer: the type and term of the mortgage they chose as well as how much they can save for a down payment. The government’s contribution, in the form of interest rates, is where a consumer will rely on their agent or broker to educate and advise them about their situation.

Where Do Mortgage Rates Come From?

Mortgage rates are influenced by three things: government policy, a borrower’s credit history, and the kind of mortgage loan at play. The government creates the environment that the lenders operate in with the Federal Reserve.

The Federal Reserve was created in 1913 in response to the Panic of 1907. Its primary purpose is to enact policy that manages inflation, encourages employment, and ultimately stabilizes interest rates. When we say interest rates here, we’re not exactly talking about mortgage interest rates, but federal funds rates. These are a little bit of a chicken and egg situation, with the federal level having a ripple effect across the lower levels of the economy.

Federal funds rates are set by the Federal Open Market Committee, which establishes a kind of baseline for individual banks to later determine their own interest rates to be. The federal funds rate is the rate that banks pay each other to borrow money overnight. Essentially, the government requires banks to have a certain amount of money within their reserves and when banks lend funds to borrowers, they then have to re-balance their reserves to meet these requirements. So, if the federal funds rate increases, chances are that banks will increase the interest rates that they charge borrowers in order to pass along the cost.

During periods of high inflation, the Fed raises interest rates to try and cut down the amount of currency circulating. By making borrowing money more expensive, the hope is that the value of money will stabilize.

How Do Interest Rates Affect Affordability?

Higher interest rates mean that the cost of a mortgage, both in terms of its lifelong interest, and in its monthly payments, are going to increase.

Your First Home — page 83

If you’re working with buyers, this means that their money is not going to go as far as it would have during lower interest periods. As grim as this all sounds, remember that the interest rates we are experiencing today, while higher than they’ve been, allow us to have a market that is still better for buyers than it has been at other times in the past.

Sometimes people put off buying a home thinking that the market or interest rate will go down. This is a short-sighted move. We encourage you and your clients to move forward with your real estate transactions regardless of the current market. For one thing, it’s possible that rates will rise rather than drop and that golden opportunity you were waiting for will pass you by. Moreover, if rates improve, depending on the situation, refinancing could get the borrower a better rate later. For example, following the high mortgage interest rates in the 1980s (12 to 18 percent), there was a period of massive mortgage refinancing when those rates dropped below 8 percent in the 1990s.

What Can You Do To Empower Your Clients?

First and foremost, the most empowering thing that you can offer your clients is perspective. While current mortgage rates are higher than they were last year, they are still at historic lows.

The long-term average for mortgage rates is actually just under 8 percent. When you consider a 5.3 percent rate (or whatever the rate of the day is when you read this, check here) against the absolute worst interest rate ever, which spiked about 18 percent as shown in the previous chart, you can see that we’re actually still in a pretty good market for borrowers.

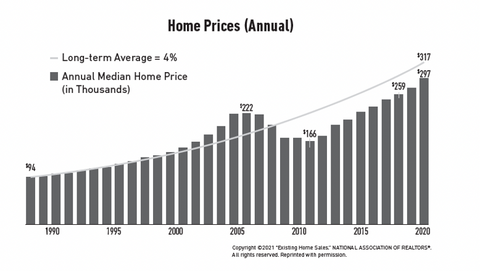

Don’t let fear drive any borrowers away from what could still be a magnificent decision. The average home in the United States appreciates at an annual rate of 4 percent — as we say in Your First Home, there never is a bad time to buy.

Your First Home — page 33

Markets go up and down. The reality is there’s never really a perfect market — just the market you’re dealing with when you’re buying your home. You’ll rarely be able to time the market, but if you can afford what you buy and hold onto it long enough, the best timing will find you.

Secondly, if you find that your clients are struggling with the affordability of a single-family home, ask them to consider other types of property that may have lower prices. A “nontraditional” first property like a condominium is an excellent way to enter a real estate journey. By allowing a person to build equity (and appreciation), properties like this are a great steppingstone to future homes.

Another great option is to consider “house-hacking.” This strategy involves purchasing a multi-unit property and using the income from tenants to pay mortgages. Some states even allow mortgage applicants who plan on having roommates in a single property to use that income to help secure their loan.

As a real-estate expert, being able to advise people about the long-term value of their choices and help them choose the right strategy will not only secure you short-term business. It will help you become a trusted professional who has a life-long relationship with a client. Don’t let mortgages scare you. More than ever, when markets are changing and people are hearing about real estate on the news, they need a fiduciary and a friend. Your clients need you.

How are rising interest rates affecting your business? What questions do you have about mortgages? Let us know on our KellerINK Facebook page! And don’t forget to subscribe to our newsletter. If you have any additional questions about mortgages or strategies for how to help your clients, don’t be afraid to reach out to info@kellerink.com.

Hello,

You have a great breakdown here of how mortgages work! It’s good to see there are some sites that have good quality info and well researched too with links.I have Mortgage PreApproval checklist here http://topsoftwaretools.com/mortgage-preapproval-checklist/ which aims to cover what we need to check before for the PreApproval..

All the best,

Tom